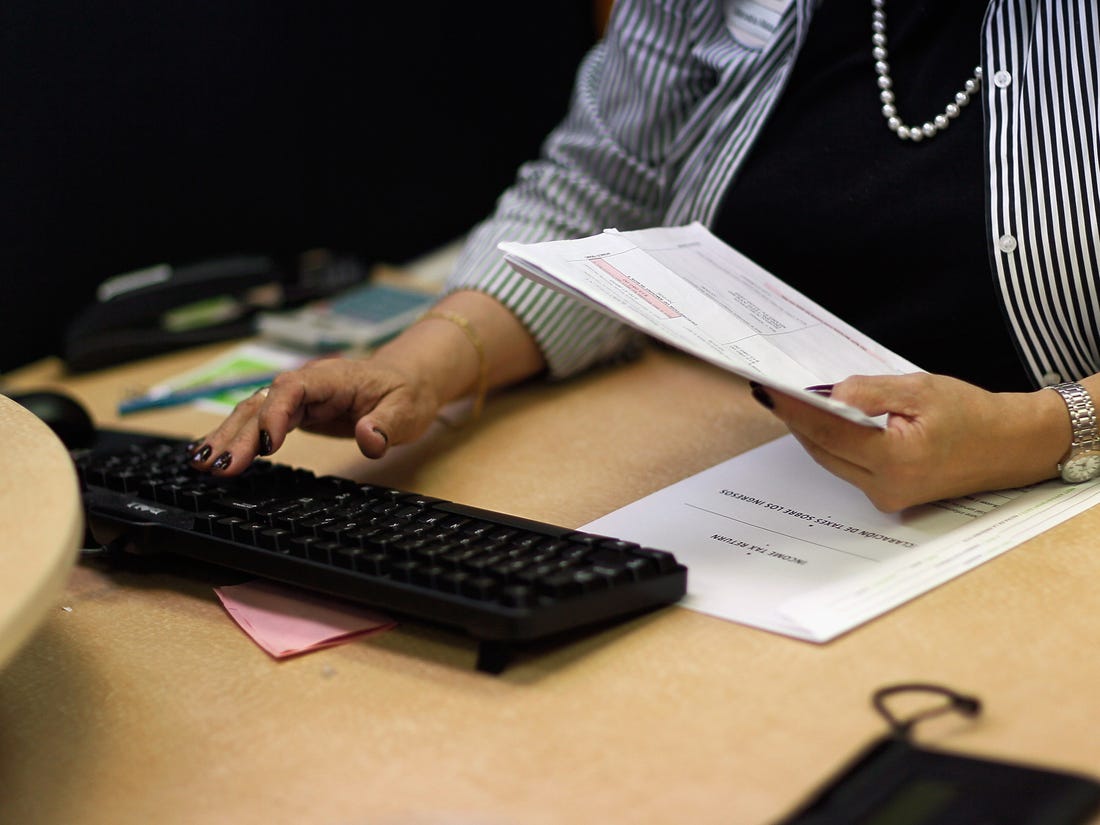

What to do when a W-2 or Form 1099 is missing or incorrect

It's important for taxpayers to have all their documents and information so they can file an accurate and complete tax return. This may mean waiting to file until they receive all their documentation – and it can also mean following up on missing or incorrect documents. Most taxpayers should have received income documents near the [...]