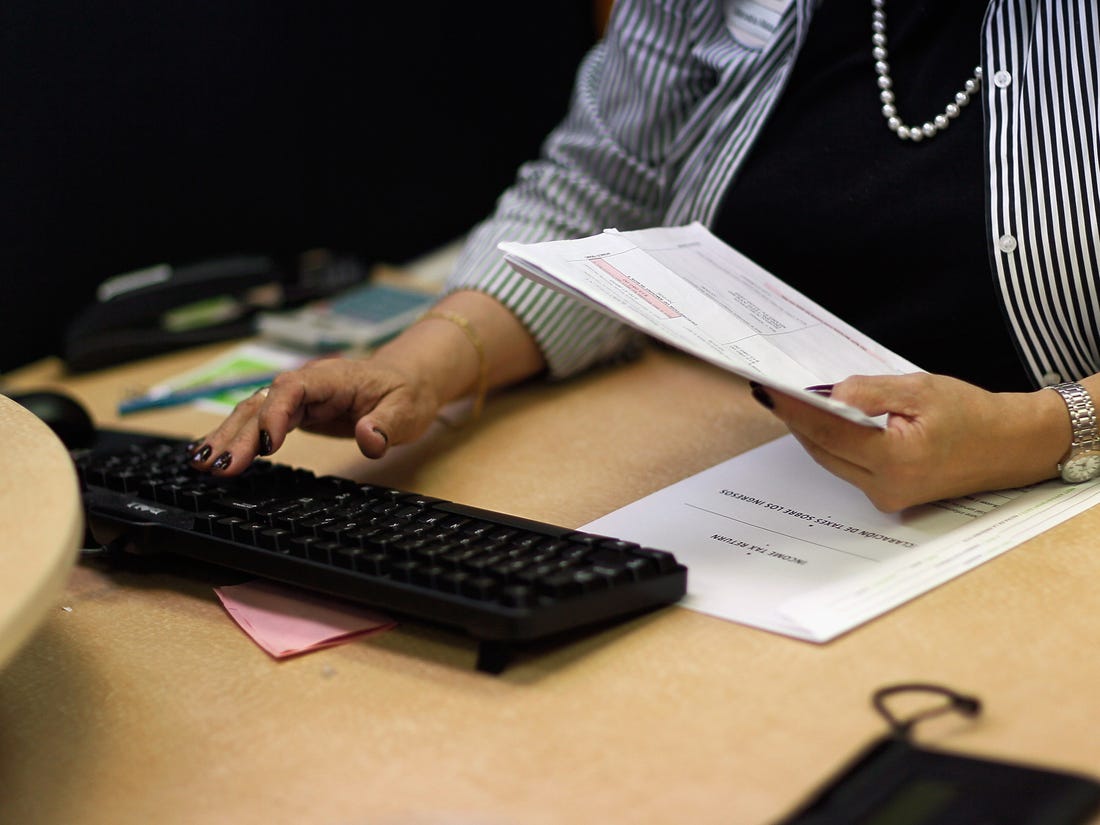

IRS reminds extension filers to have all their info before visiting a tax professional

The deadline is around the corner for taxpayers with an extension to file. It's important for taxpayers to gather all their records and get copies of any missing documents before they sit down to prepare their return, and taxpayers who use a professional tax preparer should make sure they have all their information ready before [...]