Some important things all taxpayers should do before the tax year ends

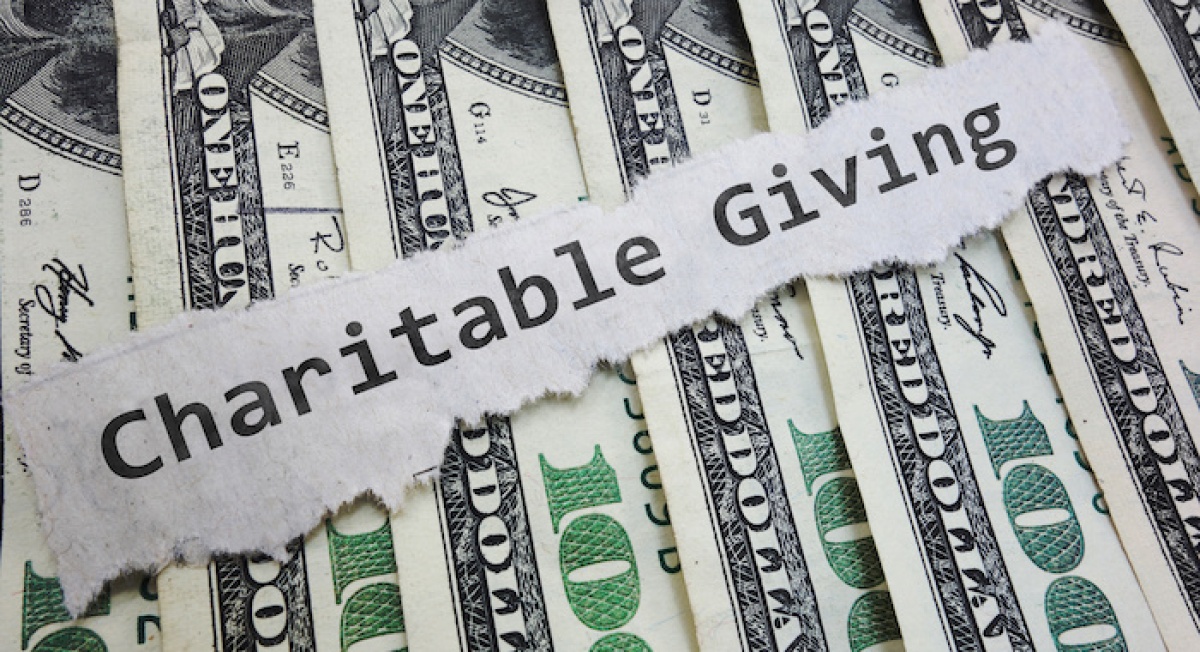

The IRS reminds taxpayers there are things they should do before the current tax year ends on December 31. Donate to charity Taxpayers may be able to deduct donations to tax-exempt organizations on their tax return. As people are deciding where to make their donations, the IRS has a tool that may help. Tax Exempt Organization [...]