There is a lot of buzz in the news about the upcoming Advance Child Tax Credit payments. The big question is, should you accept the payments or would you be better off unenrolling? The answer is not so cut and dry. The best advice we could give is to look hard at your individual situation, gather all of the necessary information and make an INFORMED decision as to which option is best for you!

In order to help make it easier, we have spent some time combing over the IRS.gov site and have gathered a series of pertinent links and key points to help you get the CORRECT information. Hopefully, this will help in making your decision with either:

- Accepting the advance payments, or

- Holding off by unenrolling and receiving the monies in one lump sum (when you file your taxes).

Read over the following information provided by the IRS to make your determination:

About the advance Child Tax Credit

About the advance Child Tax Credit

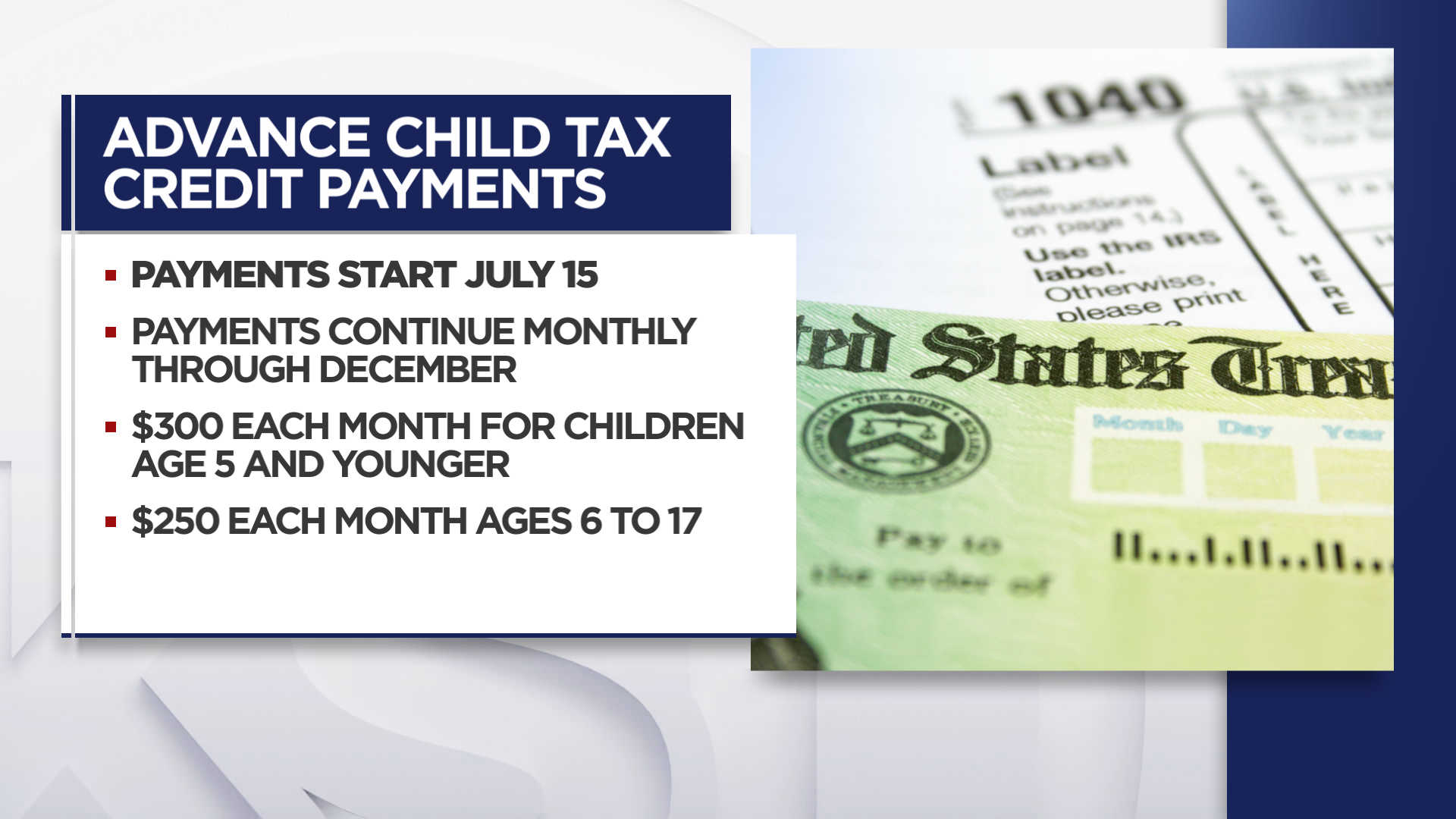

The expanded and newly-advanceable Child Tax Credit was authorized by the American Rescue Plan Act, enacted in March. Normally, the IRS will calculate the payment based on a family’s 2020 tax return, including those who use the Non-filer Sign-up Tool. If that return is not available because it has not yet been filed or is still being processed, the IRS will instead determine the initial payment amounts using the 2019 return or the information entered using the Non-filers tool that was available in 2020. The payment will be up to $300 per month for each child under age 6 and up to $250 per month for each child age 6 through 17.

To make sure families have easy access to their money, the IRS will issue these payments by direct deposit, as long as correct banking information has previously been provided to the IRS. Otherwise, people should watch their mail around July 15 for their mailed payment. The dates for the Advance Child Tax Credit payments are July 15, Aug. 13, Sept. 15, Oct. 15, Nov. 15, and Dec. 15.

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. You will claim the other half when you file your 2021 income tax return. These changes apply to tax year 2021 only.

To qualify for advance Child Tax Credit payments, you — and your spouse, if you filed a joint return — must have:

- Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return; or

- Given us your information in 2020 to receive the Economic Impact Payment using the Non-Filers: Enter Payment Info Here tool; and

- A main home in the United States for more than half the year (the 50 states and the District of Columbia) or file a joint return with a spouse who has a main home in the United States for more than half the year; and

- A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number; and

- Made less than certain income limits.

CHECK TO SEE IF YOU ARE ELEGIBLE:

You qualify for advance Child Tax Credit payments if you have a qualifying child. Also, you — or your spouse, if married filing a joint return — must have your main home in one of the 50 states or the District of Columbia for more than half the year. Your main home can be any location where you regularly live. Your main home may be your house, apartment, mobile home, shelter, temporary lodging, or other location and doesn’t need to be the same physical location throughout the taxable year. You don’t need a permanent address to get these payments. If you are temporarily away from your main home because of illness, education, business, vacation, or military service, you are generally treated as living in your main home.

To check eligibility go here: https://www.irs.gov/credits-deductions/advance-child-tax-credit-eligibility-assistant

IMPORTANT TO KNOW:

Advance Child Tax Credit payments are not income and will not be reported as income on your 2021 tax return. Advance Child Tax Credit payments are advance payments of your tax year 2021 Child Tax Credit.

However, the total amount of advance Child Tax Credit payments that you receive during 2021 is based on the IRS’s estimate of your 2021 Child Tax Credit. If the total is greater than the Child Tax Credit amount that you are allowed to claim on your 2021 tax return, you may have to repay the excess amount on your 2021 tax return during the 2022 tax filing season. For example, if you receive advance Child Tax Credit payments for two qualifying children properly claimed on your 2020 tax return, but you no longer have qualifying children in 2021, the advance Child Tax Credit payments that you received based on those children are added to your 2021 income tax unless you qualify for repayment protection. For more information regarding your eligibility for repayment protection, and how to reconcile your advance Child Tax Credit payments with your Child Tax Credit on your 2021 tax return, see Topic H: Reconciling Your Advance Child Tax Credit Payments on Your 2021 Tax Return.

For this reason, you may wish to unenroll from receiving advance Child Tax Credit payments..

SHOULD I UNENROLL FROM RECEIVING ADVANCE CHILD TAX CREDIT PAYMENTS??

SHOULD I UNENROLL FROM RECEIVING ADVANCE CHILD TAX CREDIT PAYMENTS??

You may want to unenroll from receiving advance Child Tax Credit payments for several reasons, including if you expect the amount of tax you owe to be greater than your expected refund when you file your 2021 tax return. The payments you receive are an advance of the Child Tax Credit that you would normally get when you file your 2021 tax return. Because these credits are paid in advance, every dollar you receive will reduce the amount of Child Tax Credit you will claim on your 2021 tax return. This means that by accepting advance child tax credit payments, the amount of your refund may be reduced or the amount of tax you owe may increase. You may avoid owing tax to the IRS if you unenroll and claim the entire credit when you file your 2021 tax return.

If you prefer not to receive monthly advance Child Tax Credit payments because you would rather claim the full credit when you file your 2021 tax return, or you know you will not be eligible for the Child Tax Credit for your 2021 tax year, you will be able to unenroll through the Child Tax Credit Update Portal (CTC UP).

How To Unenroll From Advance Payments

To stop advance payments, you must unenroll by June 28, 2021. Below is a chart indicating unenrollment deadlines and payment dates:

| Payment Month | Unenrollment Deadline | Payment Date |

| July | 6/28/2021 | 7/15/2021 |

| August | 8/2/2021 | 8/13/2021 |

| September | 8/30/2021 | 9/15/2021 |

| October | 10/4/2021 | 10/15/2021 |

| November | 11/1/2021 | 11/15/2021 |

| December | 11/29/2021 | 12/15/2021 |

Go Here to UNENROLL

https://www.irs.gov/credits-deductions/child-tax-credit-update-portal

2021 Child Tax Credit and Advance Child Tax Credit Frequently Asked Questions

To learn more about advance CTC payments, visit IRS.gov/childtaxcredit2021 or see FAQs on the 2021 Child Tax Credit and Advance Child Tax Credit Payments.

Note: We highly recommend contacting your Accountant or CPA if you have specific questions about your personal situation.