There were many people who accidentally threw away their stimulus payment because they thought it was junk mail. Others suspected possible scams and assumed the cards were “fake”. The Internal Revenue Service has made the decision NOT to charge for replacing those cards.

There are more than 4 million people who didn’t have direct deposit information on file with the IRS so the Internal Revenue Service began sending out economic impact payments on prepaid debit cards. And though some had their bank information on file, the IRS had problems since some of the accounts were no longer active. Some deposits had actually been put into accounts of deceased or incarcerated taxpayers (wow). To date, an estimated 159 million economic impact payments have been processed.

The hope was that the debit cards would be more convenient than checks. Benefits of the EIP Cards include the ability to make purchases, get cash from in-network ATMS’s, and transfer funds to a personal bank account with no fees being incurred.

It sounded like a great plan but the debit cards did not go out in the usual Treasury Department envelopes. So when they arrived in the mailboxes of all the recipients they were mistaken for junk mail. Unfortunately, thousands of dollars found their way into the trash cans and the much needed stimulus money was left unclaimed!

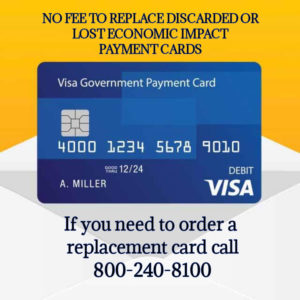

The IRS states that individuals who have destroyed (or lost) their EIP Card can request a FREE replacement. The standard fee of $7.50 will be waived for the FIRST reissue of any EIP Card. They also increased the limit on ACH transfers to a bank account from $1,000 to $2,500 per transaction.

If you need to request a card replacement you can call 800-240-8100 and select Option 2 from the main menu.

Things to know about replacement request:

*You do not need to know the card number

*The card will arrive in a plain envelope and will read “Money Network Cardholder Services”